Visible damage – sagging roofs, pooling water, damaged masonry, and cracked surfaces – found on 88 percent of replacement roofs sampled

NYCHA botched inspections and repairs, ignored warranties in 98 percent of repairs, wasting millions in public funds

In one example, NYCHA wasted $3.7 million by replacing 8 roofs while they were under warranty

19 damaged roofs found in audit could cost New Yorkers $24.6 million

The New York City Housing Authority (NYCHA) wasted millions on roof repairs that should have come at no expense to taxpayers and failed to perform basic oversight and preventive maintenance of roofs, putting the health and safety of thousands of NYCHA residents at risk, according to an audit released today by New York City Comptroller Scott M. Stringer. The Comptroller’s auditors inspected 35 roofs—all replaced since Fiscal Year (FY) 2000 and thus under a 20-year warranty—in 13 different NYCHA developments throughout the five boroughs. The audit found deficient conditions including roof sag, pooling water, open seams, and damaged masonry on 88 percent of those roofs, while NYCHA’s own inspections—if done at all—largely failed to note any problems at all in part because NYCHA still operates on obsolete, decades’ old rules. Faulty and damaged roofs can put residents in harm’s way and breed conditions ripe for mold and mildew contamination, exacerbating the public health challenges for NYCHA residents.

This audit follows a 2017 audit from Comptroller Stringer’s office in which auditors observed conditions of ponding and standing water, and poor drainage on several newly installed roofs that could jeopardize the integrity of roof systems.

“What a mess. For decades, NYCHA residents have endured leaky ceilings, mold and mildew, and our new audit sheds light on how NYCHA is failing to prevent it. We uncovered that NYCHA’s systemic failure to keep its house in order starts at the top – the roofs that should be keeping residents dry are filled with holes, just like NYCHA’s excuses,” said New York City Comptroller Scott M. Stringer. “NYCHA’s dysfunction risks the health of the residents and costs New York taxpayers millions – yet NYCHA makes no effort to hold private firms accountable to the guarantees we paid for. The hundreds of thousands of New Yorkers who call NYCHA home depend on the agency to do the most basic of tasks and to competently maintain their buildings, but this audit shows that NYCHA isn’t even trying. These are opportunities missed and dollars down the drain. This pattern of ineptitude must end.”

Of the 325 developments NYCHA operates, 304 are at least 30 years old. Roof replacements on NYCHA’s buildings require substantial investments: from FY 2000 through FY 2010, NYCHA spent approximately $452 million to replace 715 roofs—an average of $632,000 per roof. While NYCHA’s costs should be mitigated through 20-year “no-dollar limit” repair and maintenance warranties, NYCHA’s lack of consistent inspections, appropriate maintenance, and notifications to the private roof companies can void those guarantees.

The audit concluded that NYCHA had failed to implement a systematic program of preventive maintenance and roof-repair by qualified professionals because of ineffective controls at multiple levels of the organization, outdated procedures, broad noncompliance, poor record-keeping, and inattention to roof-warranty administration and enforcement.

Deficient Conditions on NYCHA’s Roofs

NYCHA’s Capital Project Division (CPD) is responsible for the replacement and installation of the Authority’s roofs, ensuring the adequacy of the contractors’ completed work, and securing the warranty. In order to uphold the warranty coverage for roof repairs, NYCHA is then required to complete regular inspections, not less than twice per year, and preventive maintenance. NYCHA’s own procedures require monthly inspections of all roofs. However, the audit found that due to NYCHA’s reliance on obsolete 30-year old procedures and a systemic lack of oversight, NYCHA failed to report and address deficient conditions that leave a roof susceptible to water intrusion and moisture under the roof membrane—an ideal condition for mold to grow. In particular, Comptroller Stringer’s audit found that:

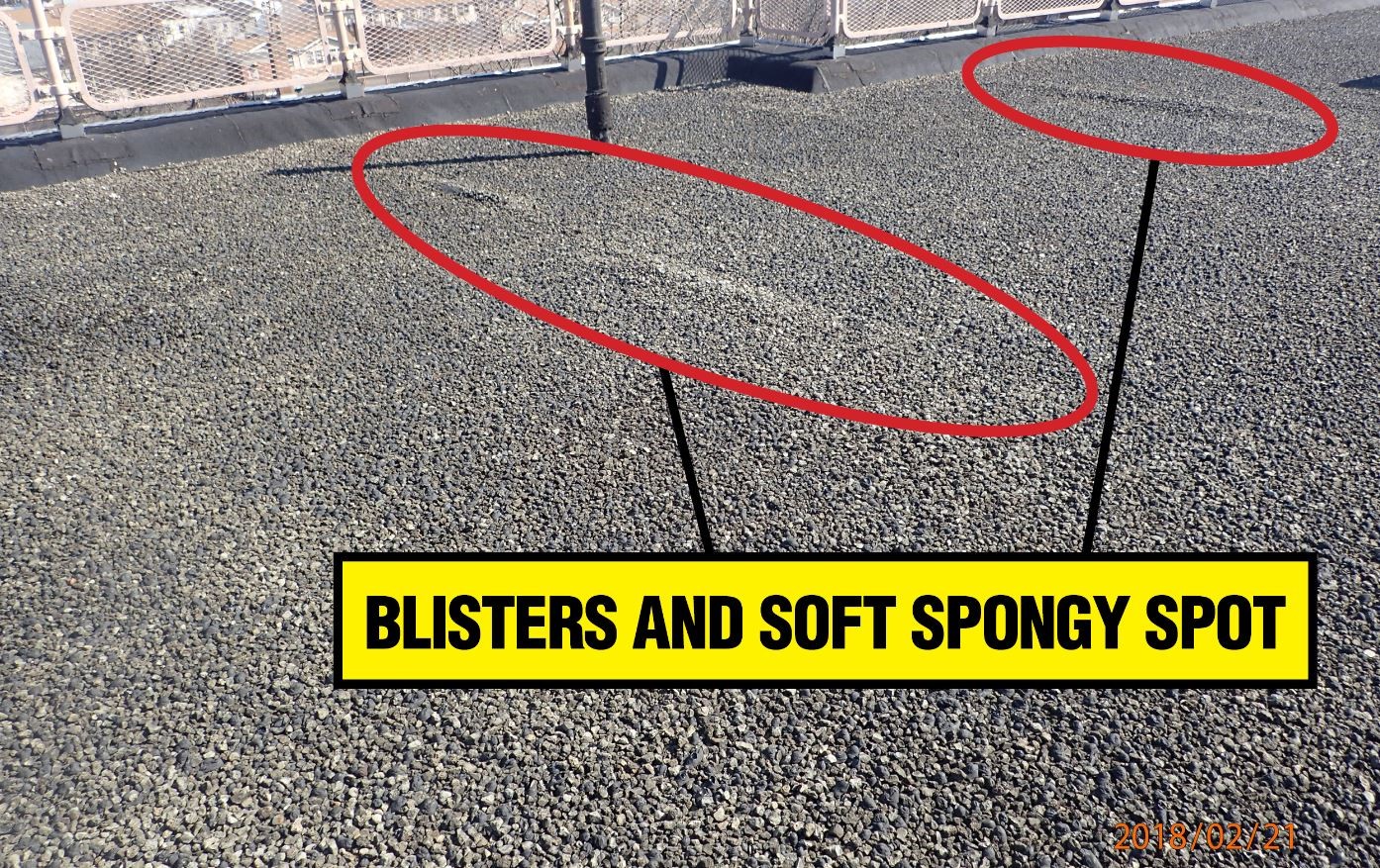

- Auditors inspected 35 sampled building-roofs located in 13 developments throughout the five boroughs, and found deficiencies across 88 percent of sampled roofs, including significant to moderate deficiencies (ponding water, soft/spongy spots, blisters and cracks, and open seams at base flashing) at over half.

- Ponding and other water penetration was uncovered on 14 roofs.

Polo Grounds Towers

Blisters and soft or spongy roof surfaces were found on 5 roofs.

|

South Jamaica Houses

Other deficiencies including trash and vegetation were found on 24 roofs.

Williamsburg Houses

Maintenance and Inspection Failures Put $24.6 Million in Jeopardy

Conditions uncovered during the audit should have been identified and addressed through monthly inspections in accordance with NYCHA’s preventive maintenance rules. However, Comptroller Stringer’s audit found:

NYCHA Failed to Utilize Warranties, Costing Taxpayers $367,000 in Loss of Investment and $3.7 Million for 8 Replacement Roofs

Auditors found that 8 roofs in NYCHA’s South Beach development on Staten Island were replaced 10 years earlier than their 20-year warranted life, costing NYCHA an investment loss of $367,000—one half their installation cost. Although those 8 roofs were covered by warranties for another ten years, NYCHA made no discernible effort to invoke the warranty coverage. Instead NYCHA spent nearly $3.7 million in public funds to replace them – an untimely, unplanned, and likely unnecessary cost that it has not fully explained.

NYCHA Ignored Roof Warranties on Over 98 Percent of its Work Orders for Repairs

In a further in-depth analysis of nearly a decade’s worth of NYCHA’s roof repair work orders, auditors found that NYCHA used its roof-warranty coverage on just 1.3 percent of the roof repairs – instead using public funds in 700 instances. From NYCHA’s available records it appears that NYCHA failed to ensure that the repair work was done in accordance with warranty terms by appropriately trained workers, a lapse that could jeopardize the warranty.

NYCHA Fails to Keep Essential Data Regarding its Roofs

At the 13 developments where auditors inspected 35 roofs:

Recommendations for Overhaul

NYCHA’s internal rules governing roof maintenance have not been updated in over 30 years. As part of this, Comptroller Stringer issued a series of recommendations to update, modernize, and overhaul NYCHA’s roof maintenance and repair systems, including:

To read Comptroller Stringer’s audit, click here.

|