|

Bronx Politics and Community events

|

"While a turtle’s shell provides protection from predators, it does not protect against being struck by vehicles while crossing roadways,” Commissioner Seggos said. “Vehicle strikes are a major cause of mortality among turtles and New York's native turtles are more susceptible at this time of year as they seek sandy areas or loose soil in which to lay their eggs. Especially in these coming weeks, DEC urges New York drivers to be on the lookout for turtles and slow down, particularly on roads near rivers and marshy areas.”

Drivers who see a turtle on the road are encouraged to slow down to avoid hitting it with their vehicle. If the vehicle can safely stop, motorists should consider moving the turtle to the shoulder on the side of the road in the direction it was facing, if drivers are able to safely do so. Motorists are advised not to pick turtles up by their tails, which could injure the turtle. Most turtles, other than snapping turtles, can be picked up safely by the sides of their shell. Snapping turtles have necks that can reach far back and have a strong bite, so if motorists try to help a snapping turtle, they should pick it up by the rear of the shell near the tail using both hands or slide a car mat under the turtle to drag it safely across the road. Do not drag the turtle by the tail as that can dislocate the tail bones.

A licensed wildlife rehabilitator may be able to help if you find an injured turtle.

DEC reminds people not to take turtles home. All native turtles are protected by law and cannot be kept without a DEC permit.

All 11 species of land turtles native to New York are in decline. Turtles are long-lived species and it takes many years for a turtle to reach maturity. Even losing one mature female can have a negative impact on a local population. Learn more about New York's native turtles at DEC's website.

Four species of sea turtles can be found in New York waters, and these turtles are all either threatened or endangered. Visit DEC's website to learn more about sea turtles. If you encounter a sea turtle on the beach, do not put it back in the water, instead call the New York State 24-Hour Stranding Hotline at (631) 369-9829 and a trained responder will provide instructions.

To help turtles and other wildlife, New Yorkers are encouraged to:

To help turtles and other wildlife, New Yorkers are encouraged to:

Reduce, Reuse, Recycle, and Rethink: these are simple steps to help protect all wildlife;

Don't litter: unwanted trash makes its way just about everywhere, including into our creeks, lakes, rivers, and the ocean;

Don't release balloons or lanterns: releasing balloons into the environment is potentially fatal for many different wildlife, including sea turtles that commonly mistake balloons and plastic bags for prey items like jellyfish;

Volunteer for beach and park clean-ups; and

Stay informed and share your knowledge with others.

DEC recognizes May 23 as World Turtle Day®. American Tortoise Rescue (ATR), a not-for-profit organization dedicated to the protection of all species of tortoise and turtle, created World Turtle Day® to celebrate and protect turtles and tortoises and their disappearing habitats around the world. These gentle animals have been around for 200 million years, yet are rapidly disappearing due to smuggling, the exotic food industry, climate change, loss of habitat, and the illegal pet trade.

Damian Williams, the United States Attorney for the Southern District of New York, announced that Arthur Hayes was sentenced to six months of home detention, in connection with his violation of the Bank Secrecy Act (the “BSA”), through his willful failure to establish, implement, and maintain an anti-money laundering (“AML”) program at the cryptocurrency company he co-founded and owned, Bitcoin Mercantile Exchange or “BitMEX”. U.S. District Judge John G. Koeltl imposed today’s sentence.

U.S. Attorney Damian Williams said: “While building a cryptocurrency platform that profited him millions of dollars, Arthur Hayes willfully defied U.S. law that requires businesses to do their part to help in preventing crime and corruption. He intentionally failed to implement and maintain even basic anti-money laundering policies, which allowed BitMEX to operate as a platform in the shadows of the financial markets. This Office will continue to vigorously enforce United States law intended to prevent money laundering through financial institutions, including cryptocurrency platforms.”

According to the Indictment, public court filings, and statements made in court:

ARTHUR HAYES, together with BENJAMIN DELO and SAM REED, who have also pled guilty and are scheduled to be sentenced in the near-future, was one of the three co-founders and the CEO of BitMEX.

BitMEX is an online cryptocurrency derivatives exchange that, during the relevant time period, had U.S.-based operations and served thousands of U.S. customers, notwithstanding false representations to the contrary by the company, including HAYES. From at least September 2015, and continuing at least through the time of the Indictment in September 2020, HAYES willfully caused BitMEX to fail to establish and maintain an AML program, including a program for verifying the identify of BitMEX’s customers (or a “know your customer” or “KYC” program). As a result of its willful failure to implement AML and KYC programs, BitMEX was in effect a money laundering platform. For example, in May 2018, HAYES was notified of allegations that BitMEX was being used to launder the proceeds of a cryptocurrency hack. Neither HAYES nor the company filed a suspicious activity report thereafter, nor did they implement an AML or KYC program in response.

HAYES failed to institute AML or KYC programs at BitMEX despite closely following U.S. regulatory developments that made clear their legal obligation to do so if BitMEX operated in the United States, which it did. Despite repeatedly stating that BitMEX did not serve U.S. customers, including to members of the press and others outside of BitMEX, HAYES knew that BitMEX’s purported withdrawal from the U.S. market in or about September 2015 was a sham, and that “controls” BitMEX put in place to prevent U.S. trading were an ineffective facade that did not, in fact, prevent users from accessing or trading on BitMEX from the United States.

HAYES derived substantial profits from BitMEX, as a result of U.S.-based trading, and aggressively advertised the company’s lack of an AML or KYC program. At various points in time, BitMEX’s website stated that “No real name or other advanced verification is required on BitMEX.” Through at least August 2017, the platform’s registration page explicitly stated that first and last name were “not required” to register.

Because of the lack of KYC, the full scope of criminal conduct on BitMEX may never be known. The company, still owned by HAYES and his co-defendants, accepted a settlement with the Department of Treasury in which the Company neither admitted nor denied that that it had conducted more than $200 million in suspicious transactions, and that the Company had failed to file suspicious activity reports on nearly 600 specific suspicious transactions.

HAYES, 36, of Miami, Florida, was sentenced to six months of home detention and two years of probation. Hayes also agreed to pay a fine of $10 million dollars representing his pecuniary gain from the offense.

Mr. Williams praised the outstanding investigative work of the Federal Bureau of Investigation’s New York Money Laundering Investigation Squad, and thanked the attorneys and investigators at the Commodity Futures Trading Commission whose expertise and diligence were integral to the development of this case.

"We’ve been here before. Too many times over the past few years, we’ve seen case counts rise and failed to take meaningful action to save lives before hospitalizations and death counts rise as well. As cases rise across NYC, and the city moves to a “high” covid alert level, we cannot sit idly and wait for more of our neighbors and friends to contract COVID-19. Hospitalizations and deaths have yet to spike, and while we're thankful, we must take steps intentionally now to prevent that from happening in the near future.

"This is why, effective today, my office is moving to remote work for the next thirty days. We are calling on all other government officials to do the same where practical. Taking steps to lessen the amount of people in high risk settings now can help prevent more restrictive measures later. Government can and should set the example. In addition to working remotely, New Yorkers should be strongly encouraged to wear masks indoors to prevent further spread of this highly contagious variant. We must reduce our burden on the already over-taxed health care system and prevent further restrictions and losses; in life and economic.

"New Yorkers know how to protect each other. It’s time to mask up, get boosted, test regularly, and stay home when possible."

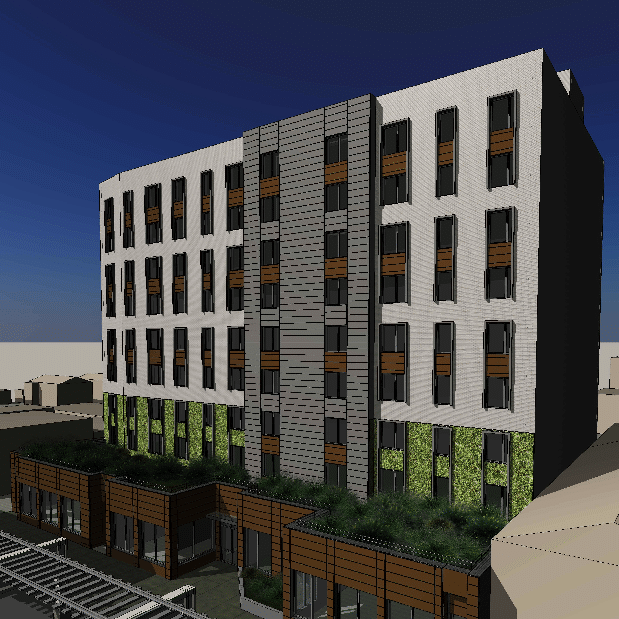

Construction is set to break ground this week at 4519 White Plains Road, a new affordable and supportive housing development in the Wakefield section of The Bronx. As the latest project from The Doe Fund and Robert Sanborn Development, the building will provide 98 affordable homes, 20 apartments reserved for tenants 62 and older, and on-site supportive services for 49 formerly homeless individuals.

Construction is scheduled to begin Wednesday, May 25. The building will debut as The Plains.

“I’m proud to have overseen the growth of The Doe Fund’s transitional, affordable, and supportive housing portfolio to over 1 million square feet,” said John McDonald, executive vice president of housing at The Doe Fund. “When completed, the Plains will join this essential continuum of care, providing high quality homes to 98 of our fellow New Yorkers most in need, as well as their families.”

Designed by OCV Architects, the building will comprise 82,465 square feet. Upon completion, available homes will be available to low and moderate-income individuals and households who meet the income eligibility thresholds ranging from 30 to 80 percent of the area median income (AMI). Preference will be given to local residents who are homeless or at risk of becoming homeless.

Amenity spaces will include tenant storage, a flexible lounge and multipurpose space, on-site laundry facilities, a fitness center, and outdoor recreation space. The Doe Fund will deliver housing and clinical case management services to residents, including mental health and medical care.

To improve energy efficiency, the property will feature a green roof and solar array, high-efficiency electrical and HVAC systems, LED lighting throughout, ENERGY STAR-certified appliances in each residence, and triple-glazed windows with thermal breaks that reduce the amount of energy needed to maintain a preferable internal temperature.

Total development costs are estimated at $48.5 million.

“The Doe Fund has been a pillar of supportive housing in New York City for over 30 years, and we are honored to have been part of the recent The Plains transaction in the Bronx,” said Michael Milazzo, senior vice president, originations at Merchants Capital. “As one of the nation’s top affordable housing financiers, we at Merchants are always looking for new ways to serve the housing needs of populations across the U.S. By working with The Doe Fund, we are creating safe, new, and supportive housing for nearly 100 of New York’s most vulnerable residents.”

Funding for the project includes a mix of public programs and private sources. Along with a 2019 Empire State Supportive Housing Initiative (ESSHI) award and federal Low Income Housing Tax Credits, New York State Housing and Community Renewal-approved awards from the Supportive Housing Opportunity Program, the All Affordable New York City Program, and the NYS HOME program. The Doe Fund also obtained private-sector construction and permanent loans through Merchants Capital and Freddie Mac, and tax-credit equity was syndicated by Richman Housing.

In addition, the New York State Homeless Housing and Assistance Corporation awarded capital funding through the Homeless Housing Assistance Program. The Corporation for Supportive Housing also provided an acquisition loan that included funds for acquisition and pre-development.

Carl Carro, Previously Arrested for Operating a Multi-Million Dollar Ponzi Scheme, Now Charged with Tax Fraud for Evading More Than $75,000 in Taxes

New York Attorney General Letitia James and New York State Department of Taxation and Finance Acting Commissioner Amanda Hiller announced the arrest and arraignment of Carl Carro (60) of Walton, NY, for failing to pay more than $75,000 in New York state taxes over the past six years. Carro — who was previously arrested for operating a multi-million dollar Ponzi scheme — is now charged with failing to file income taxes from 2017 through 2019 and for filing a false income tax return in 2020, following his arrest on the prior charges. Between 2012 and 2020, Carro allegedly defrauded dozens of investors out of millions of dollars through a scheme involving fake promises of prospect interviews and investment opportunities. Instead of investing funds, he allegedly diverted them for personal expenses, including paying credit card bills, pet expenses, and more. Carro was charged for his failure to report the millions of dollars that he fraudulently solicited from unsuspecting investors as income.

“When businesses and individuals defraud our tax system, it deprives communities of public funds for vital services and programs,” said Attorney General James. “Not only did Carl Carro allegedly cheat investors out of millions of dollars, he also deceived and stole from our state to conceal his crime. Fraud of any kind is never acceptable, and my office will continue to ensure those who steal from our communities will be held accountable to the fullest extent of the law.”

“The tax crimes alleged in this case show a blatant disregard for our tax laws and for all New Yorkers who rely on the vital services and programs that these taxes fund,” said Acting Commissioner Hiller. “We’ll continue to work with Attorney General Letitia James, her office, and all levels of law enforcement to root out all forms of tax fraud.”

A joint investigation by the Office of the Attorney General (OAG) and the Department of Taxation and Finance (DTF) revealed that Carro failed to report taxable income he earned during the course of the Ponzi scheme he allegedly operated. While the new charges reflect crimes committed from 2015 through 2020, a DTF audit found that Carro underreported his income by more than $2 million and failed to pay more than $100,000 in taxes owed to New York state since at least 2012.

In January 2021, Carro was charged for his role in a Ponzi scheme that defrauded more than 50 investors in New York and across the nation out of millions of dollars. As alleged in the prior complaint, Carro and his co-defendant James Doyle pretended to be managers of headhunting companies, Endeavor Management Solutions and Endeavor Consultancy. The two individuals allegedly lured victims with false promises of interviews for board positions and offered fake investment opportunities in their firm with guaranteed profit returns. However, instead of investing the funds, they used investors’ funds for personal expenses and to pay back previously defrauded investors. The two individuals allegedly spent nearly $600,000 on cash withdrawals, more than $200,000 to pay credit card bills, squandered nearly $120,000 on pet expenses, and exhausted more than $350,000 to pay previously defrauded investors.

Carro is charged with multiple counts of Criminal Tax Fraud in the Third Degree (class D felony), Criminal Tax Fraud in the Fourth Degree (class E felony), Offering a False Instrument for Filing in the First Degree (class E felony), and Repeated Failure to File Personal Income Tax Returns (class E felony). If convicted, Carro faces up to 10 to 20 years in state prison.

Carro, who was previously out on bail in the securities fraud case, was arraigned before the Honorable Andrew Z. Skrobanski in the village of Sidney, acting as town of Walton justice, and was remanded pending a bail hearing. If convicted of all charges, Carro faces up to 10 to 20 years in state prison.

The charges against the defendant are allegations and he is presumed innocent unless and until proven guilty.

The OAG wishes to thank DTF’s Criminal Investigations Division for their valuable assistance in this investigation.

Damian Williams, the United States Attorney for the Southern District of New York, and Michael J. Driscoll, the Assistant Director-in-Charge of the New York Field Office of the Federal Bureau of Investigation (“FBI”), announced that CHIBUNDU JOSEPH ANUEBUNWA, a citizen of Nigeria, was extradited from the United Kingdom and arrived in the United States this afternoon. ANUEBUNWA was extradited on charges of conspiracy to commit wire fraud and wire fraud in connection with his alleged participation in a multimillion-dollar business email compromise campaign that targeted thousands of victims around the world, including in the United States. ANUEBUNWA will be presented today before U.S. Magistrate Judge Katharine H. Parker. The case is assigned to U.S. District Judge Paul A. Crotty. In connection with the same conspiracy as ANUEBUNWA, co-defendant DAVID CHUKWUNEKE ADINDU was previously sentenced to 41 months in prison, and co-defendant ONYEKACHI EMMANUEL OPARA was previously extradited from South Africa and sentenced to 60 months in prison.

U.S. Attorney Damian Williams said: “As alleged in the indictment, Chibundu Joseph Anuebunwa tried to steal money from thousands of businesses around the world by impersonating corporate executives and sending phony emails to company employees. This extradition should serve as a warning to those who think they can defraud victims in the United States from halfway around the world: the United States and its international partners will find you and hold you accountable no matter how long it takes.”

According to the allegations in the Indictment unsealed today in Manhattan federal court[1]:

Between 2014 and 2016, ANUEBUNWA, OPARA, and ADINDU participated in business email compromise scams (“BEC scams”) targeting thousands of victims around the world, including in the United States. As part of the BEC scams, emails were sent to employees of various companies directing that funds be transferred to specified bank accounts. The emails purported to be from supervisors at those companies or third-party vendors that did business with those companies. The emails, however, were not legitimate. Rather, they were either from email accounts with a domain name that was very similar to a legitimate domain name, or the metadata in the emails had been modified so that the emails appeared as if they were from legitimate email addresses. After victims complied with the fraudulent wiring instructions, the transferred funds were quickly withdrawn or moved into different bank accounts. In total, the BEC scams attempted to defraud millions of dollars from victims.

ANUEBUNWA and others carried out BEC scams by exchanging information regarding: (1) bank accounts used for receiving funds from victims; (2) email accounts used for communicating with victims; (3) scripts for requesting wire transfers from victims; and (4) lists of names and email addresses for contacting and impersonating potential victims.

ANUEBUNWA, 39, of Lagos, Nigeria, is charged with one count of conspiracy to commit wire fraud, which carries a maximum penalty of 20 years in prison, and one count of wire fraud, which also carries a maximum penalty of 20 years in prison.

The maximum potential sentences are prescribed by Congress and are provided here for informational purposes only, as any sentencing of the defendant will be determined by the judge.

Mr. Williams praised the investigative work of the FBI and thanked the Yahoo E-Crime Investigations Team for their assistance. The U.S. Department of Justice’s Office of International Affairs of the Department’s Criminal Division provided significant assistance in securing the defendant’s extradition from the United Kingdom. Mr. Williams also thanked the United Kingdom’s Crown Prosecution Service for their assistance in today’s extradition.

The charges contained in the Indictment are merely accusations and the defendants are presumed innocent unless and until proven guilty.