MTA Faces Substantial Gaps That Will Require Cost and Revenue Solutions

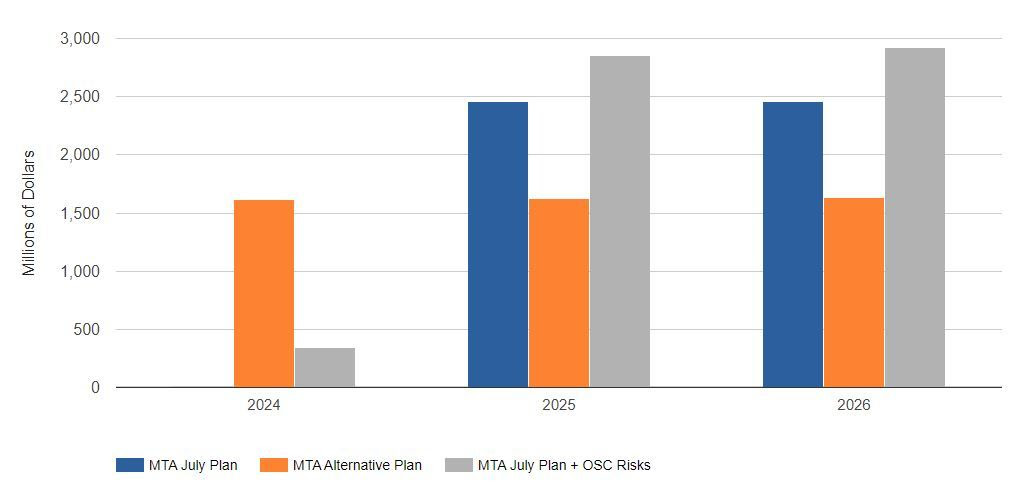

Even before the pandemic, the Metropolitan Transportation Authority, which provides transit (subway and bus), express bus, commuter rail and paratransit services to the New York region, faced difficulties in closing its projected budget gaps. These gaps were exacerbated by the pandemic, which took a substantial toll on ridership and related revenue, necessitating an unprecedented level of federal funding to maintain service operations. The MTA reports that budget gaps will total more than $2.5 billion annually once federal pandemic relief is exhausted in 2025, in addition to $401 million in known budget risks, and other difficult to quantify spending and economic risks, detailed in an October 2022 report by the Office of the State Comptroller (OSC).

The forecasted budget gaps and emerging risks will eventually require the MTA to balance its budget either by raising revenue or reducing expenses. Current MTA projections anticipate annual average spending growth of 3 percent compared to 4 percent in the decade prior to the pandemic. OSC has encouraged the MTA to examine using cost and revenue efficiencies, such as better alignment of train service with demand, to potentially provide more cost-efficient service while improving farebox revenue. The current target of $100 million in unspecified savings should be identified and can be expanded substantially to help close the gaps. However, efficiencies alone are unlikely to close gaps of this magnitude, meaning more painful decisions for the MTA and its riders, via raising fares beyond historically accepted increases, finding new sources of subsidies or decreasing service to reduce costs. Each of these poses risks for the region’s economic recovery.

The MTA has suggested to its board that decreasing service is currently not part of its financial plan given the availability of federal aid, and that the Authority’s reduction of service would be counter to regional economic recovery. Recognizing the impact of the fundamental change in its revenue composition with more people working from home leading to less regular ridership, the Authority has cited the need for new revenue to maintain service at or near pre-pandemic levels. To reflect the actual trajectory of transit and commuter rail ridership’s return more closely, the MTA is using a new ridership analysis developed by its consultant, McKinsey. McKinsey expects MTA-wide utilization trends to reach new baselines between 73 percent and 88 percent of pre-pandemic levels by 2026. Bolstering ridership and the revenue it generates by committing to safe, reliable and frequent service remains the most sustainable way to improve the MTA’s finances and close budget gaps.

The MTA’s current financial plan identifies recurring budget gaps of over $2.5 billion starting in 2025, after it uses nearly all of its federal relief aid to fund operations over the next two years. The Authority has also put forward an alternative plan to narrow its recurring budget gaps through 2028 by using early debt repayment (see Figure 1). However, budget gaps would emerge earlier, beginning in 2023, before settling at about $1.6 billion in 2024. As part of the plan, the MTA would also eliminate a projected $180 million in recurring debt service costs through 2053, which are associated with debt for operations that the Authority borrowed during the height of the pandemic. The paydown of the outstanding notes and bonds would reduce the size of the budget gaps by an average of $915.4 million through 2028.The budget gap emerging in 2023 would accelerate a conversation over how to raise the revenue necessary to help close the budget gaps in combination with spending adjustments. Avoiding the long-term cost of borrowing for operations and paying down debt are generally sound budgetary practices. After 2028, however, another fiscal cliff will approach as the proposed debt defeasances end. The MTA’s presentation of its revenue needs should extend further to help the public understand ridership expectations and other sources of revenue and how its decisions now will help it respond to filling this new, although more manageable, budget gap.

This brief looks to understand the current composition of MTA revenue, analyze changes to MTA revenue over time, and provide a comparison of revenue against other large U.S. transit systems. The trend and comparison analysis provides some considerations of the MTA’s revenue composition over time and against peers for the public, its board and legislators to assist decisionmakers in pursuing revenue options to close upcoming budget gaps. The MTA’s peers are less reliant on farebox revenue and are funded more like an essential service. The MTA, too, has characterized itself the same way in recent months.

FIGURE 1: MTA Budget Gaps

Note: OSC risks are provided in detail in OSC Report 9-2023: Financial Outlook for the Metropolitan Transportation Authority.

Sources: Metropolitan Transportation Authority; OSC analysis

MTA Revenue Sources

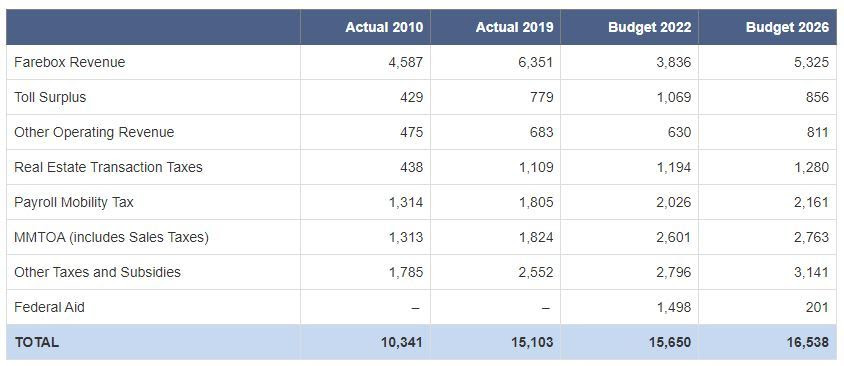

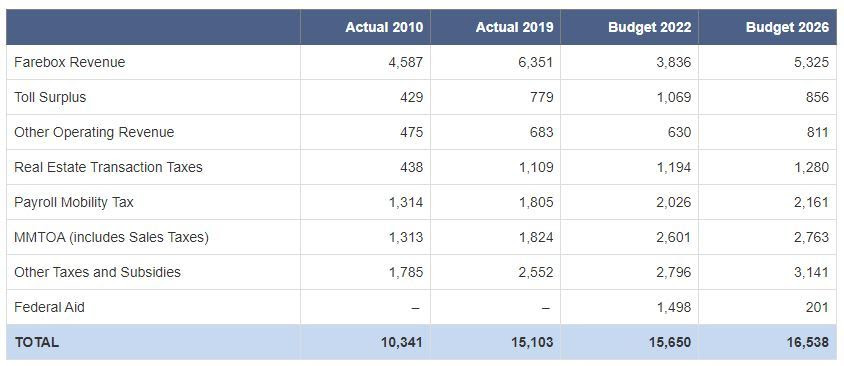

MTA revenue from the Great Recession until the pandemic had grown consistently, led by a period of economic growth and regular, anticipated fare increases. OSC selected 2010 as a baseline year for this analysis, as this was the first full year the MTA received the payroll mobility tax, a surcharge levied on employer payrolls in the 12-county commuter district. This new tax was needed to replace revenue to the MTA from the real estate transaction tax, which dropped from $1.6 billion in 2007 to $389 million in 2009 and $438 million in 2010.

As shown in Figure 2, MTA farebox revenue was about $4.6 billion, or 44.4 percent of total revenue, in 2010. The MTA raised fares five times between 2010 and 2019 which, coupled with increased ridership, led to a fare revenue increase of 38.5 percent by 2019, to nearly $6.4 billion. Despite these increases, fares as a percentage of total revenue declined slightly to 42.1 percent in 2019, which was mostly due to substantial growth in other revenues, most notably real estate transaction taxes. Overall revenue growth, excluding fare revenue, rose by 52 percent. Other revenues grew substantially as economic growth continued, most notably led by real estate transaction taxes which more than doubled during that period (153 percent).

FIGURE 2: MTA Farebox Revenues as Percentage of Total Revenue

The pandemic decimated fare revenues at the MTA and at transit systems across the country. Ridership still has not returned to pre-pandemic levels with fares expected to be only 24.5 percent of total revenue in 2022. The drop in fare revenue has been substantially made up via federal pandemic relief aid to the Authority. The MTA has $5.6 billion in federal aid to be spread over the period from 2023 through the end of the financial plan, dropping off substantially beginning in 2025.1

Fare revenue is expected to be the largest source of growth among all revenue sources between 2022 and 2026, rising by 29 percent. The MTA expects fare revenue (including proposed fare increases in 2023 and 2025) to rebound to 32.2 percent of total revenue in 2026, but that remains 10 percentage points lower than its share in 2019. (The share of total revenues in 2026 would be 30.7 percent without proposed fare increases.)

In contrast, none of the MTA’s major tax subsidy sources, including the Metropolitan Mass Transportation Operating Assistance (MMTOA), payroll mobility tax and real estate transaction taxes, are expected to rise by more than 7 percent over the same period, with toll revenue remaining flat over the period.2 Each of these revenue sources would also be materially impacted by a severe recession. The City, which levies real estate transaction taxes on a broader set of properties than the MTA, assumes real estate related tax collections will decline and not recover through 2026.

As shown in Figure 3, fare revenue in 2026 (even including proposed fare increases in 2023 and 2025) would still be lower both in terms of dollars and as a share of the budget than in 2019, which is contributing to a fiscal cliff. The MTA currently forecasts a $2.5 billion budget deficit in 2026 as extraordinary federal funding that is currently helping it to offset the decline in fare revenue and balance its budget is mostly exhausted. If the MTA were to raise fares beyond what is budgeted to reach 2019 levels, the increase would be more than 19 percent from currently planned levels, including proposed fare increases.

FIGURE 3: MTA Revenue Sources (Excluding MTA Bridges &

Note: Farebox revenue in 2026 includes planned fare increases in 2023 and 2025.

Sources: Metropolitan Transportation Authority; OSC analysis

|

Note: Farebox revenue in 2026 includes planned fare increases in 2023 and 2025.

Sources: Metropolitan Transportation Authority; OSC analysis

Comparison of MTA Revenues with Other Large Transit Systems

Even before the pandemic, the MTA was unique in its reliance on riders and also in its commuters’ reliance on the MTA’s services. More than half of City residents used public transit to commute to work in 2019. The New York City metro area also had the largest share of commuters who use public transit among comparable metro areas served by combined bus and subway operations in the U.S.

As shown in Figure 4, in 2019, MTA farebox revenue contributed 42.1 percent of revenue dedicated to mass transit while other transit systems in large U.S. cities selected below ranged from 31 percent in Boston’s Massachusetts Bay Transportation Authority (MBTA) to 35.7 percent in the Washington Metropolitan Area Transit Authority (WMATA). If the MTA received subsidies in 2019 at the same rate as WMATA, it would have received another $700 million. If it received subsidies in 2019 at the same rate as the MBTA, it would have received another $1.7 billion. The other two systems analyzed, Philadelphia’s Southeastern Pennsylvania Transportation Authority (SEPTA) and Chicago’s Regional Transportation Authority (RTA), both had subsidy revenue shares within this range.

Comparable systems chosen for this analysis were picked based on their size and the provision of bus, commuter, and heavy rail (subway) services and the share of total revenues provided by fares prior to the pandemic. One comparable system by size and services, the Los Angeles County Metropolitan Transportation Authority (LACMTA), was left out as fares made up less than 10 percent of total revenue in 2019. LACMTA is also unique in that it received federal operating support that exceeded fare revenue in that year. Generally, federal operating revenue is a minor portion of major transit system revenues.

Even before the pandemic, the MTA was unique in its reliance on riders and also in its commuters’ reliance on the MTA’s services. More than half of City residents used public transit to commute to work in 2019. The New York City metro area also had the largest share of commuters who use public transit among comparable metro areas served by combined bus and subway operations in the U.S.

As shown in Figure 4, in 2019, MTA farebox revenue contributed 42.1 percent of revenue dedicated to mass transit while other transit systems in large U.S. cities selected below ranged from 31 percent in Boston’s Massachusetts Bay Transportation Authority (MBTA) to 35.7 percent in the Washington Metropolitan Area Transit Authority (WMATA). If the MTA received subsidies in 2019 at the same rate as WMATA, it would have received another $700 million. If it received subsidies in 2019 at the same rate as the MBTA, it would have received another $1.7 billion. The other two systems analyzed, Philadelphia’s Southeastern Pennsylvania Transportation Authority (SEPTA) and Chicago’s Regional Transportation Authority (RTA), both had subsidy revenue shares within this range.

Comparable systems chosen for this analysis were picked based on their size and the provision of bus, commuter, and heavy rail (subway) services and the share of total revenues provided by fares prior to the pandemic. One comparable system by size and services, the Los Angeles County Metropolitan Transportation Authority (LACMTA), was left out as fares made up less than 10 percent of total revenue in 2019. LACMTA is also unique in that it received federal operating support that exceeded fare revenue in that year. Generally, federal operating revenue is a minor portion of major transit system revenues.

FIGURE 4: MTA Revenue Sources Compared to Other Large Transit Systems, 2019

Note: MTA does not include MTA Bridges & Tunnels revenue but includes the toll surplus provided to mass transit.

Sources: Metropolitan Transportation Authority; Other systems' financial statements; OSC analysis

Of the five systems examined here, three (RTA, MBTA and SEPTA) are primarily subsidized by state and local sales tax. In 2019, the RTA received 92 percent of its subsidies from various sales taxes while MBTA and SEPTA received more than 75 percent of its subsidies from sales taxes. By comparison, WMATA receives all of its subsidies from county budgets and by the Washington, D.C. budget. It is also notable that two of the systems, RTA and WMATA, receive a higher share of revenue from other operating sources. The Metropolitan Transportation Sustainability Advisory Workgroup, charged with understanding the MTA’s revenue woes in 2018, suggested leveraging advertising and real estate assets as an area for new revenue generation initiatives.

In 2019, the MTA received 45 percent of its subsidies from taxes tied to economic activity including employment and consumer consumption, such as the payroll mobility tax and sales and use tax, corporate surcharges and petroleum business tax revenues. A portion of these subsidies are deposited in the MMTOA account and then distributed to all downstate transit providers, including the MTA.

The MTA also receives subsidies from often volatile real estate transaction taxes, which made up 14 percent of tax subsidies in 2019 but only 8 percent in 2010. In addition, while the MTA currently anticipates real estate transaction taxes will grow from 2022 to 2026, New York City has already projected that these taxes will decline by about 23 percent in City fiscal year (FY) 2023 and remain below FY 2022 levels through FY 2026 while the MTA anticipates these taxes will grow throughout the plan period. Of the other systems examined, only the RTA receives funding (8 percent of subsidies in 2019) from real estate taxes.

The MTA is also the only one of the five systems examined here to receive toll subsidies as surplus toll revenue, for mass transit. This surplus from MTA Bridges & Tunnels crossings is then dedicated to New York City Transit and the commuter railroads. In 2019, drivers contributed a total of $1.4 billion to the MTA’s mass transit services through these tolls and through motor vehicle fees, auto rental taxes and congestion surcharges on taxi and for-hire vehicle rides in or originating in the central business district of Manhattan.3 The MTA also receives funds from local governments’ budgets, including New York City's.

The MTA must continue to search out operating efficiencies and identify and expand cost-saving options in order to close its expected budget gaps. It must also report on these savings initiatives progress to help the public understand just how much of the gap can be closed without putting additional pressure on riders and taxpayers. However, their magnitude makes it unlikely that they can be closed by reducing spending alone without leading to a substantial reduction in services and hurting the regional economic recovery. The MTA will have to provide its board with options that rely on raising revenues as well, and the board’s control is limited to raising fares and tolls. Ultimately, State, City and federal leaders will also need to be a part of the discussion if the MTA is to identify and secure additional subsidies to achieve balanced budgets and maintain operations.

Endnotes

1 The $5.6 billion is net of federally funded expenditures that have already been accrued or agreed upon, including $800 million in Federal Emergency Management Agency aid for prior expenditures associated with the COVID-19 pandemic, $776 million expected to be used in 2022 and $598 million for replacing a portion of City subsidies for MTA Bus and the Staten Island Railway. Total COVID-19 pandemic aid planned to be used from 2022 through 2026 is approximately $6.9 billion.

2 MMTOA provides general operating subsidies for the MTA and downstate transportation systems. MMTOA funds come from sales and use taxes and a corporate surcharge on general business corporations in the Metropolitan Commuter Transportation District, and a share of statewide corporate franchise tax and petroleum business taxes.

3 The MTA also received $649 million in 2019 from petroleum business taxes imposed on petroleum businesses but not directly paid by drivers.