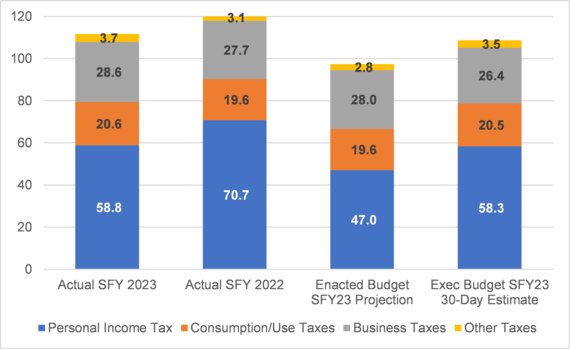

Tax collections for State Fiscal Year (SFY) 2022-23 totaled $111.7 billion, $2.9 billion higher than the forecast released by the Division of the Budget (DOB) in the Amended Executive Budget financial plan at the beginning of March but $9.5 billion lower than the previous year, according to the March State Cash Report released today by New York State Comptroller Thomas P. DiNapoli.

The year over year decline was primarily due to a decline in Personal Income Tax (PIT) receipts resulting from a variety of factors including: a decline in year-end bonuses in the financial services industry, claiming of credits related to the Pass-Through Entity Tax (PTET), the acceleration of the final phase-in of the middle-class tax rate cuts, and financial market volatility over the course of 2022.

“The financial position of the state remains on a solid footing, for now,” DiNapoli said. “While tax collections have exceeded projections, they were considerably lower than last year. Although easing, inflation continues to present challenges to economic growth. State policy makers should ensure that the enacted budget for State Fiscal Year 2023-24 commits additional resources to the state’s reserve funds to improve long-term financial stability.”

PIT collections totaled $58.8 billion, nearly $12 billion, or 16.9%, lower than prior year collections. PIT collections exceeded March Financial Plan projections by $454.6 million and by $11.8 billion from the Enacted Budget, as taxpayer behavior in response to the new PTET was contrary to DOB’s forecasts.

Consumption and use taxes, which includes sales tax, totaled $20.6 billion, exceeding the prior year total by $964 million or 4.9%. Collections were $50.2 million higher than the latest projections and $1 billion higher than initial projections.

Business tax collections totaled $28.6 billion which was $891.8 million higher than the previous year, reflecting a 24.6% increase in corporate franchise taxes due to continued growth in corporate profits and a significant amount of audit receipts. This total includes $14.9 billion in PTET collections which were $1.5 billion, or 9%, lower than SFY 2021-22. Total business tax collections exceeded the latest projections by $2.2 billion and initial projections by $636.4 million.

All Funds spending totaled $220.5 billion, which was $11.1 billion, or 5.3%, higher than last year. The General Fund ended the fiscal year with a balance of $43.45 billion, an increase of $10.4 billion from the opening balance. This includes $2.35 billion of federal funds from the American Rescue Plan State Fiscal Relief program. Actions taken by DOB at the end of the fiscal year include:

- Deposits of $2.75 billion and $183 million to the Rainy Day and Tax Stabilization Reserve Funds, respectively, $213 million lower than anticipated.

- $6.2 billion in debt service pre-payments.

- $920 million transferred to the retiree health benefit trust fund.

- The deferment of nearly $4 billion in Medicaid provider payments from March to April, including $1.8 billion of state share payments.

Report

No comments:

Post a Comment