Taiwanese National Arrested for Misrepresenting Employee Payroll Figures for Multiple Companies to Receive COVID-19 Loan Funds; Spent Over $275,000 of Loan Proceeds on Personal Luxury Expenses

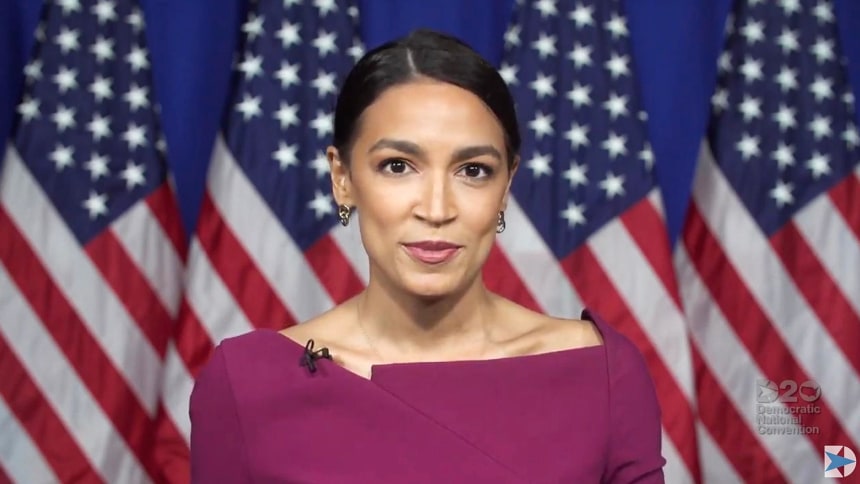

Audrey Strauss, the Acting United States Attorney for the Southern District of New York, William F. Sweeney Jr., Assistant Director-in-Charge of the New York Office of the Federal Bureau of Investigation (“FBI”), Kevin Kupperbusch, Special Agent-in-Charge of the Eastern Region Office of the Inspector General of the U.S. Small Business Administration (“SBA”), and Jonathan D. Larsen, Special Agent in Charge of the New York Field Office of the Internal Revenue Service, Criminal Investigation (“IRS-CI”), announced today the arrest of SHENG-WEN CHENG, a/k/a “Justin Cheng,” a/k/a “Justin Jung,” a Taiwanese national residing in New York, New York, for a fraudulent scheme to obtain over $7 million in government-guaranteed loans designed to provide relief to small businesses during the novel coronavirus/COVID-19 pandemic. In connection with loan applications for relief available from the Paycheck Protection Program (“PPP”) and the Economic Injury Disaster Loan (“EIDL”) Program, CHENG used the identities of other individuals to falsely represent to the SBA and five financial institutions that companies controlled by him had a total of over 200 employees and paid $1.5 million in monthly wages, when, in fact, his companies appear to have a total of no more than 14 employees. Of the approximately $2.8 million in PPP loan proceeds that CHENG has received to date, CHENG transferred over $880,000 abroad, withdrew approximately $360,000 in cash and/or cashier’s checks, and spent over $275,000 on personal expenses. CHENG was charged with several counts of fraud, including major fraud against the United States, wire fraud, and bank fraud, as well as one count of aggravated identity theft for forging the electronic signature of a payroll company employee in payroll documents provided to financial institutions. CHENG was arrested this morning and will be presented later today before U.S. Magistrate Judge Stewart D. Aaron.

Acting U.S. Attorney Audrey Strauss said: “At a time when so many small businesses and their employees are facing dire financial straits, Sheng-Wen Cheng allegedly saw not an emergency lifeline but a gravy train. As alleged, Cheng fraudulently applied for over $7 million in government-guaranteed loans under programs designed to provide relief for small businesses financially strapped by the COVID-19 pandemic. Cheng allegedly lied to the Small Business Administration and several financial institutions about ownership of his companies, the number of people the companies employed, and how any loan proceeds would be applied, and he used forged and fraudulent documents in the process. Of the nearly $3 million he actually received, Cheng allegedly transferred nearly $1 million to overseas accounts, and spent nearly $300,000 on personal luxury items such as an 18-carat gold Rolex, a $17,000-a-month luxury condo, and a Mercedes. The paid vacation ended with his arrest this morning.”

FBI Assistant Director William F. Sweeney Jr said: “While small business owners throughout the country sought loans from the Paycheck Protection Program in order to pay employee wages and maintain basic business functions, Justin Cheng, a self-proclaimed ‘serial entrepreneur,’ acquired more than $3 million in financial relief, which he then used for personal benefit, as alleged today. True entrepreneurs who have been trying to keep their businesses afloat during these trying times are directly affected by this type of fraud, while the taxpaying citizens of this country are indirectly impacted by all those who siphon money illegitimately from this multibillion-dollar program. This isn’t the first case of SBA fraud we’ve seen, and it won’t be the last, but rest assured those who try to buck the system will be met with federal criminal charges wherever and whenever possible.”

SBA Special Agent-in-Charge Kevin Kupperbusch, said: “This is a critical time for our nation’s small businesses. Our Office will continue to combat fraud schemes that involve SBA’s programs for personal gain and greed. I want to thank the U.S. Attorney’s Office and our law enforcement partners for their dedication and pursuit of justice.”

IRS-CI Special Agent in Charge Jonathan D. Larsen said: “As alleged in the criminal complaint, Mr. Cheng fraudulently took advantage of programs meant to help those in need during a world-wide pandemic. IRS-CI will continue to prioritize investigations where criminals seek to steal money from well-deserving citizens amidst this ongoing public health crisis.”

According to the allegations contained in the Complaint[1] unsealed today in Manhattan federal court:

The Coronavirus Aid, Relief, and Economic Security (“CARES”) Act is a federal law enacted on March 29, 2020, designed to provide emergency financial assistance to the millions of Americans who are suffering the economic effects caused by the COVID-19 pandemic. One source of relief provided by the CARES Act was the authorization of hundreds of billions of dollars in forgivable loans to small businesses for job retention and certain other expenses through the SBA’s PPP. Pursuant to the CARES Act, the amount of PPP funds a business is eligible to receive is determined by the number of employees employed by the business and their average payroll costs. Businesses applying for a PPP loan must provide documentation to confirm that they have previously paid employees the compensation represented in the loan application. The CARES Act also expanded the separate EIDL Program, which provided small businesses with low-interest loans that can provide vital economic support to help overcome the temporary loss of revenue they are experiencing due to COVID-19. To qualify for an EIDL Program loan under the CARES Act, the applicant must have suffered “substantial economic injury” from COVID-19.

CHENG, a Taiwanese national who entered the United States on a student visa, is a self-proclaimed “serial entrepreneur” who earned a Bachelor’s Degree from Pennsylvania State University (“Penn State”). From at least in or about April 2020 through at least on or about August 13, 2020, CHENG appears to have used the identities of other individuals to submit online applications to the SBA and at least five financial institutions for a total of over $7 million in government-guaranteed loans through the SBA’s PPP and EIDL Program for several companies controlled by CHENG, namely Alchemy Finance, Inc., Alchemy Guarantor LLC d/b/a “Celer Offer,” Celeri Network, Inc., Celeri Treasury LLC, and Wynston York LLC (collectively, the “Cheng Companies”). In connection with these loan applications, CHENG represented, among other things, that other individuals were the sole owners of the Cheng Companies and that the Cheng Companies together had over 200 employees and paid a total of approximately $1.5 million in wages to those employees on a monthly basis. In fact, however, the Cheng Companies appear to have a total of no more than 14 employees.

In order to support the false representations in the loan applications about the number of employees at and the wages paid by the Cheng Companies, CHENG submitted fraudulent and doctored tax records that were never actually filed with the IRS, and payroll records containing the forged electronic signature of a payroll company employee. CHENG also submitted a payroll summary for one of his companies that listed the names of more than 90 purported employees, several of whom are current and former athletes, artists, actors, and public figures. For example, the list of purported employee names included a co-anchor on Good Morning America, a former National Football League player, and a prominent Penn State football coach who is now deceased.

Based on the fraudulent PPP loan applications submitted by CHENG, a total of more than $3.7 million in PPP loans were approved for the Cheng Companies and approximately $2.8 million in PPP loan proceeds were deposited into bank accounts solely controlled by CHENG as of on or about August 13, 2020. Based on bank records received to date, instead of using the PPP loan proceeds for payroll costs, mortgage interest, rent, and/or utilities for the purported Cheng Companies as required by the PPP, CHENG used a portion of the $2.8 million in loan proceeds he received as follows:

- A total of at least approximately $881,000 in PPP loan proceeds was transferred to accounts of different individuals and entities located at banks based in Taiwan, the United Kingdom, South Korea, and Singapore.

- A total of at least approximately $360,000 in PPP loan proceeds appears to have been withdrawn in cash and/or cashier’s checks.

- A total of at least approximately $279,000 in PPP loan proceeds was spent on personal expenses, including the purchase of an 18-carat gold Rolex watch for approximately $40,000, rent and move-in fees for a $17,000 per month luxury condominium for CHENG, approximately $50,000 of furnishings for CHENG’s condominium, at least approximately $80,000 toward the purchase of a 2020 S560X4 Mercedes, and purchases totaling approximately $37,000 at Louis Vuitton, Chanel, Burberry, Gucci, Christian Louboutin, and Yves Saint Laurent.

- A total of at least approximately $160,000 in PPP loan proceeds was transferred to Alchemy Marketplace, another company owned and controlled by CHENG, in international accounts.

CHENG, 24 of New York, New York, is charged with one count of bank fraud, one count of wire fraud, and one count of making false statements to a bank, each of which carries a maximum sentence of 30 years in prison; one count of major fraud against the United States, which carries a maximum sentence of 10 years in prison; one count of making false statements, which carries a maximum sentence of five years in prison; one count of making false statements to the SBA, which carries a maximum sentence of two years in prison; and one count of aggravated identity theft, which carries a mandatory sentence of two years in prison to be served consecutively to any other sentence imposed. The maximum potential sentences are prescribed by Congress and are provided here for informational purposes only, as any sentencing of the defendant will be determined by the judge.

Any businesses or individuals who believe they may have been a victim in this investigation or have information regarding this investigation should call the FBI at 1-800-CALL-FBI (225-5324).

Ms. Strauss praised the investigative work of the FBI, SBA-OIG, and IRS-CI, and noted that the investigation remains ongoing. Ms. Strauss also thanked U. S. Customs and Border Protection and the New York State Department of Labor for their assistance with the investigation.

The charges contained in the Complaint are merely accusations, and the defendant is presumed innocent unless and until proven guilty.